Escrow

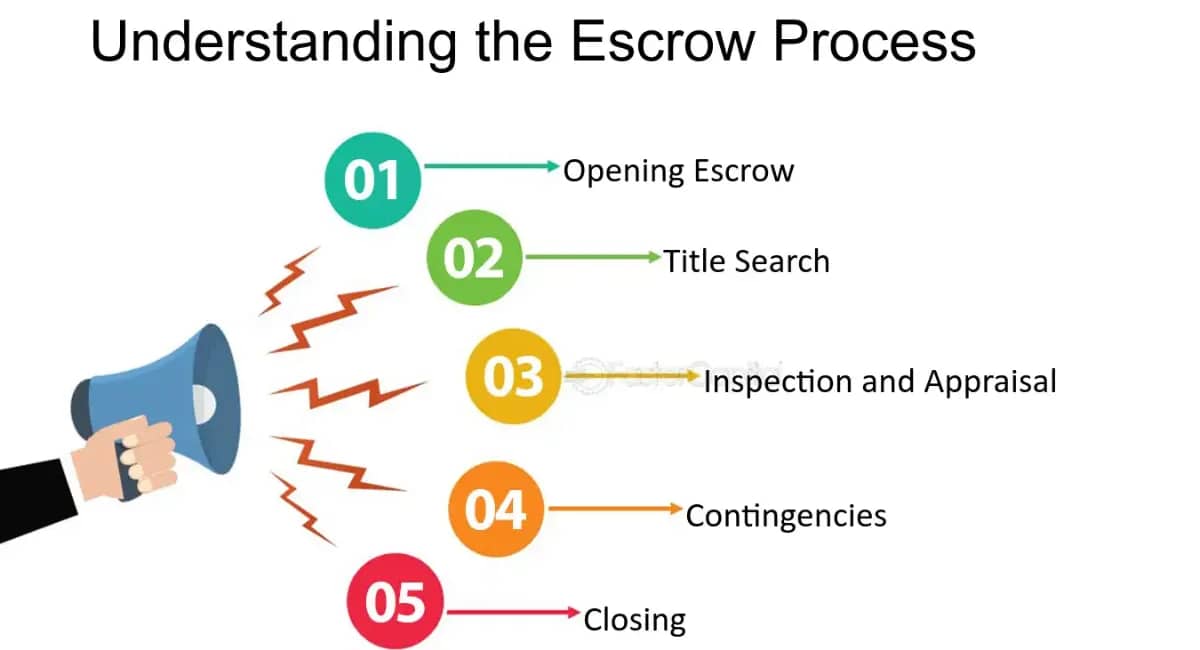

Escrow means giving something to a neutral third party to hold until certain conditions are met. The escrow officer can be a lawyer or title company, depending on where the transaction occurs.into escrow. Once you have a signed contract, contact an escrow officer—your real estate agent can recommend one—and put all the important documents and money into escrow.

The Escrow Officer

The escrow officer oversees the deal for a fee of about $1,000. They make sure that:

- All paperwork is signed and recorded publicly

- Both buyer and seller follow the contract

- All money is exchanged

- A title search is done (see below)

The Preliminary Title Report

After opening escrow, you’ll receive the preliminary title report, or “prelim,” from the title company. The report will show:

- The name of the property owner

- Taxes or liens against the property

- Third-party restrictions include public or private easements, such as granting permission for an electricity company to place a pole on your property.

At this stage, the title contingency in your contract comes into play. Look over the report very carefully. If there are surprises, such as a lien you didn’t know about, you have the right to insist that the seller settle the claims or reduce the purchase price.

Inspection

To get a mortgage, you typically have to get the home inspected. The inspection is meant to protect both you and the lender. Even if the lender doesn’t require one, you should still have a professional check the house carefully to avoid serious problems or issues that insurance won’t cover.

4o mini

Interior and exterior inspection: This checks all important parts of the house, like the foundation, insulation, kitchen, bathroom, plumbing, heating, cooling, electricity, walls, roof, and gutters. The inspection should take at least three hours and cost around $250–500.

Pest control inspection: This looks for signs of pests or mold and usually costs about $75–$150.

- If you’re planning to renovate, have a general contractor or architect inspect the house and give an estimate of the renovation cost

How to Choose an Inspector

Hire an independent inspector who is not connected to your real estate agent. Don’t choose an inspector based on price because paying for a quality inspector can save you plenty of money in the long run. A good inspector should:

- Belong to the American Society of Home Inspectors

- Ensure the inspector has insurance to pay you if they make a mistake.

- Give you a detailed written report.

- Let you come along on the inspection

- Provide references and have satisfied clients

The Inspection Checklist

The written report your inspector provides should cover these interior and exterior areas of your property:

Ceilings, chimneys, cooling systems, decks, porches, balconies, doors, drainage systems, fireplaces, floors, foundations, gutters, heating systems, pests, plumbing, pool, roof, siding, stairs, walkways, walls, windows, wiring, yard.

If the Inspection Uncovers Problems

If the inspector finds problems, the inspection contingency in the contract allows you to renegotiate. Ask the seller to pay for the needed work or lower the purchase price.

Appraisal

Lenders typically require prospective home buyers to hire an appraiser to assess the property’s fair market value—what the property is worth. Though lenders often offer to conduct and even pay for this service, hiring an independent appraiser yourself is a good idea. A complete and accurate appraisal should look at all of these parts of the property:

- Appearance

- Condition

- Build quality

- Location

- Unique features

- Upgrades

- Value of comparable properties

Homeowner’s Insurance

To get a mortgage, most lenders require you to have homeowner’s insurance to protect your home (and the lender’s investment) from:

- Damage (like fire, flood, etc.): Choose a policy with guaranteed replacement costs so you have full coverage to rebuild.

- Loss of personal property: Most policies cover about 70% of losses, but pricier policies cover the full replacement cost.

- Liability (if someone gets hurt on your property): Make sure your liability coverage is at least twice the value of your home.

The amount you pay monthly for insurance (premiums) depends on how much coverage you have and where the house is located. If you’re buying in an area prone to things like floods or earthquakes, you’ll need to add extra coverage (which can be expensive). Don’t skip these extras—they’re important.

Mortgage Application

To get a mortgage, most lenders require you to have homeowner’s insurance to protect your home (and the lender’s investment) from:

- Damage (like fire, flood, etc.): Choose a policy with guaranteed replacement costs so you have full coverage to rebuild.

- Loss of personal property: Most policies cover about 70% of losses, but pricier policies cover the full replacement cost.

- Liability (if someone gets hurt on your property): Make sure your liability coverage is at least twice the value of your home.

The amount you pay monthly for insurance (premiums) depends on how much coverage you have and where the house is located. If you’re buying in an area prone to things like floods or earthquakes, you’ll need to add extra coverage (which can be expensive). Don’t skip these extras—they’re important.

Title and Owner’s Insurance

The title is the legal ownership of a particular piece of real estate.When you buy a property, the ownership (title) transfers to you (or your lender). Occasionally, a real estate sale may transpire when the title doesn’t transfer from seller to buyer due to error or fraud. Though such an oversight isn’t usually the buyer’s fault, the buyer pays if things go wrong

Title Insurance

For a hefty one-time fee of 0.5%–1% of the mortgage value, the title company (which often acts as the escrow officer) researches the property’s title and guarantees it’s valid. If it turns out that the title company’s research was wrong—the title was invalid, and someone has made a claim against the land—the title company will cover your costs.

Owner’s Insurance

The title insurance you buy protects your lender, but it won’t necessarily protect you after you’ve paid off the mortgage. When you purchase title insurance, make sure you’re buying a policy that protects both the lender and the homeowner. In some states, the two policies come bundled together. In other states, you may have to pay an additional fee of $30 or so.

Taking Title

Taking title means transferring the title from the seller to the buyer for a single homeowner. When this happens, the buyer becomes the only owner of the property. If you’re buying property jointly with another person, you’ll have to choose the form you want your co-ownership to take—how you’d like to take title.

Joint tenancy is the most popular way of taking title when two people buy a home. In a joint tenancy, both owners share equal property ownership, so one owner can’t sell or change the property without the other owner’s permission. Most couples opt for joint tenancy because it provides tax breaks should one member die and the other inherit full home ownership.

Walkthrough

Before closing escrow (the day you officially become the owner of your new home), you’ll have a final chance to walk through the house. This lets you inspect the property one last time to ensure no new damage has happened since your last visit. The verifying condition contingency allows you to renegotiate should you discover any significant last-minute problems.

Closing Escrow (The Closing)

The closing is the last meeting between the buyer, the seller, their agents, lawyers, and an escrow officer who handles the checks and finishes the deal (in some states, you might have already given the money before the closing). As the buyer, you’ll receive the following at the closing: Deed of trust on the property Mortgage note Final sales contract Closing statement (recording all the money involved in the transaction)

Get Our Latest News First

Related Latest News Posts:

- Home Loan 101: Mortgage Basics You Should Know: Simplify your home loan journey with key mortgage basics, expert advice, and tips to secure your ideal loan

- Should You Buy a Home?: Should You Buy a Home?. Owning a home is usually a more brilliant money choice than renting. Yet buying

- How to Buy a Home for Zero Down: Buy a Home for Zero Down payment is possible, but it might end up costing you more in the long run because

- What is a Credit History and a Credit score?: When deciding to approve your mortgage, a lender will look at your credit history, which shows how well you’ve repaid loans like

- How to Get a Professional Home Inspection: Why pay for a home inspection? A home inspection will help buyers uncover home defects before investing.

Leave a Reply